Home » Cyber Insurance Milton Keynes

Protect against ransomware, data breaches, and system failures with specialist support from Milton Keynes’ dedicated cyber security and insurance experts in the heart of the smart city.

Cyber insurance serves as your business’s digital lifeline when sophisticated threats target your operations. Whether it’s ransomware locking down your finance systems, phishing attacks compromising customer data, or supply chain cyber incidents disrupting your operations, traditional business insurance falls short. Cyber insurance steps in where conventional cover ends.

This specialised protection covers incident response costs, legal fees, forensic investigations, data recovery, business interruption, and regulatory penalties. It’s not a substitute for robust cybersecurity; it’s your essential safety net when digital defences are breached.

Have an enquiry? We’re just an email or call away!

Milton Keynes sits at the epicentre of Britain’s digital transformation. With major financial services headquarters at Unity Place, advanced logistics operations at Magna Park, and cutting-edge engineering at Tilbrook, MK businesses handle sensitive data at an unprecedented scale.

Local business media have already warned Milton Keynes firms about the surge in inbox attacks targeting finance teams and supplier payment systems. From professional services firms along Midsummer Boulevard to manufacturing operations in Blakelands, cyber criminals are actively targeting MK’s thriving business community.

Recent analysis shows the average UK ransomware incident costs businesses £18,500 in immediate recovery and downtime. Factor in lost contracts from Unity Place financial services, delayed shipments from Magna Park logistics, or compromised IP from motorsport engineering firms, and the true cost escalates rapidly.

The question for Milton Keynes businesses isn’t whether you’ll face a cyber threat—it’s how quickly you’ll recover when it happens.

Our cyber policies are specifically designed for Milton Keynes’ diverse business landscape, from smart city technology firms to established logistics operators. Every policy provides comprehensive protection across two essential areas: direct business impact (first-party coverage) and third-party claims protection.

Last year, UK cybercrime reached £21 billion in losses. Milton Keynes businesses are prime targets.

From financial services operations at Unity Place handling millions in transactions daily, to logistics firms at Magna Park managing complex supply chains, MK businesses operate in data-rich environments that criminals actively exploit.

Many business owners still believe they’re beneath the radar of cyber criminals. The reality is starkly different. If your business processes payments through Tongwell’s financial district, stores customer data in cloud systems, or coordinates supply chains from Caldecotte Lake Business Park, you’re already a potential target.

The cost of delaying protection extends beyond immediate financial impact. It encompasses your hard-earned reputation, customer relationships, and potentially your entire business future. Local competitors who suffer major cyber incidents often struggle to recover their market position.

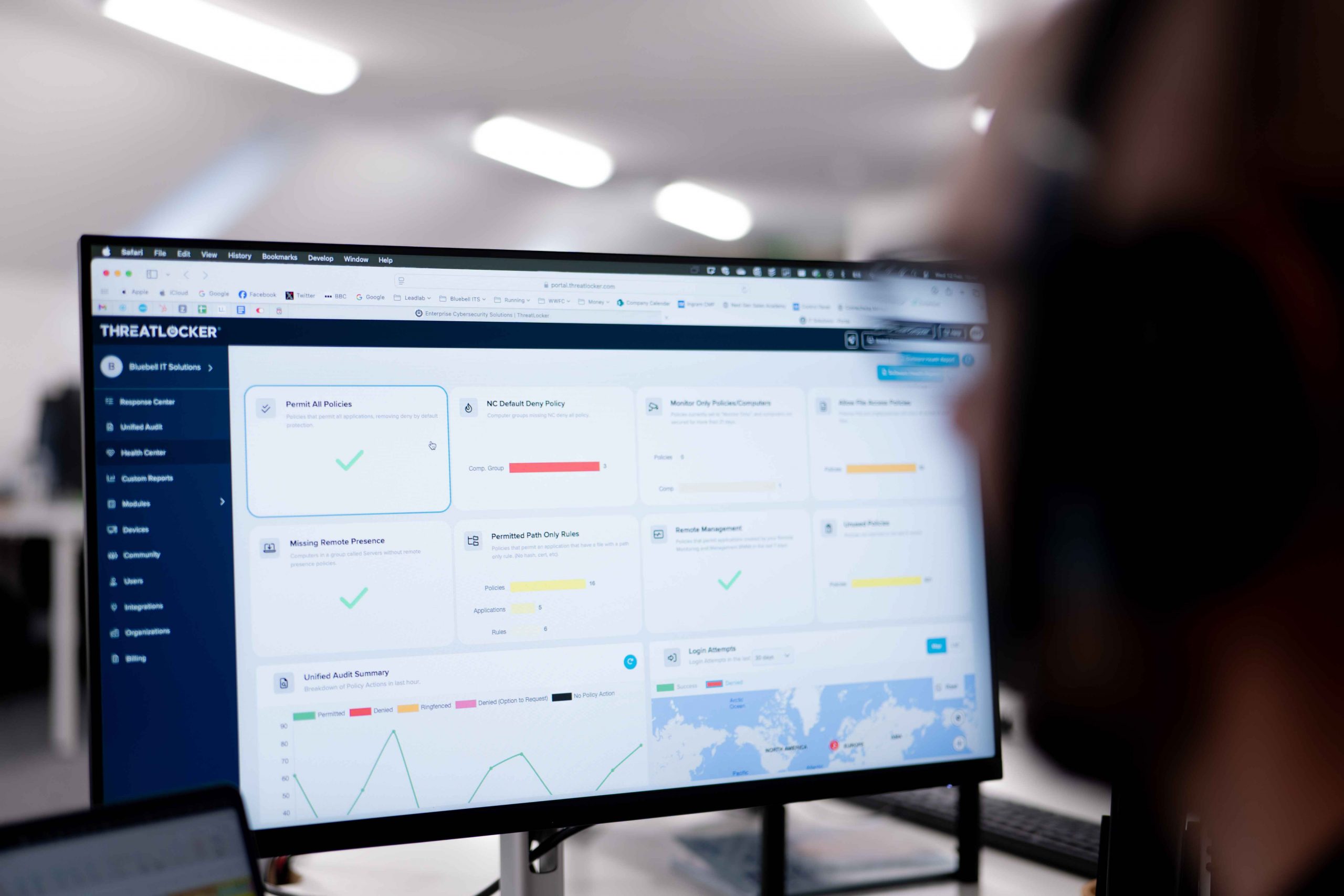

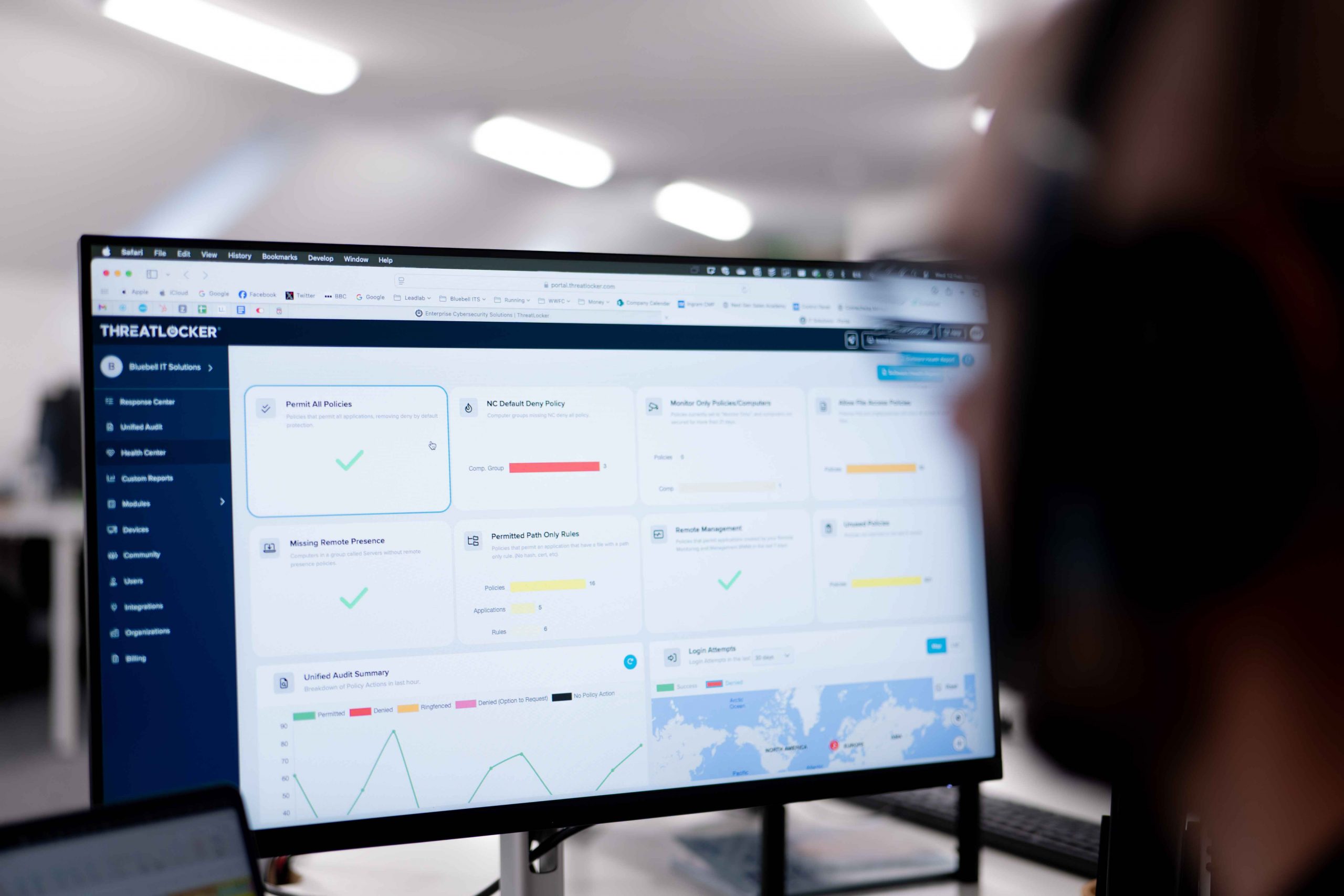

What sets Bluebell apart is our deep understanding of Milton Keynes’ unique business ecosystem. We’re not a distant national broker; we’re embedded in MK’s commercial community. When crisis strikes, we’re here locally, not at the end of a busy call centre queue.

Your Milton Keynes business needs cyber insurance if you:

Even smaller enterprises face significant exposure. A single phishing email targeting your Linford Wood office could result in devastating financial and reputational consequences.

Think your Blakelands manufacturing firm is too small to attract attention? Cyber criminals increasingly prefer smaller businesses. You possess valuable data and operational systems, but typically maintain lighter security defences than large corporations. You represent the ideal target profile.

if your Milton Keynes business relies on computers, internet connectivity, or digital communications to operate, cyber insurance isn’t optional, it’s essential.

If you’re considering cyber insurance as just another business expense, it’s time to reconsider the mathematics.

Without insurance protection, your business assumes responsibility for IT forensics, legal representation, customer communications, operational downtime, and potentially substantial compensation claims.

Cyber threats continue accelerating across Milton Keynes’ digital business landscape. Consider cyber insurance not as an optional expense, but as fundamental protection for your company’s future.

Curious about cyber protection costs for your Milton Keynes business?

Our complimentary risk assessment takes just 15 minutes and provides clear, customised pricing based on your business size, sector, and existing cyber defences.

Understanding the specific threats helps explain why cyber insurance matters for MK businesses.

Real Threats Facing Milton Keynes Operations:

Here’s your Milton Keynes business response when properly covered:

You’ll connect instantly with cybersecurity specialists who’ll contain the breach, investigate the attack vector, and prevent further system compromise.

Experts analyse exactly how the attack occurred, which systems were accessed, and whether data was exfiltrated or corrupted.

You’ll receive expert legal support to meet GDPR and ICO reporting obligations. Where legally permitted, regulatory penalties may be covered.

Your policy covers costs for notifying affected individuals and managing public narrative to protect your business reputation.

We help restore your operations safely and efficiently, minimising downtime and rebuilding customer confidence.

If customers pursue legal action or regulators investigate, you’re protected for defence costs and compensation settlements.

We’re Milton Keynes cybersecurity specialists who understand your local business challenges.

Localised cyber insurance means your provider understands the unique risks in Milton Keynes’ business landscape, like threats to finance teams at Unity Place or logistics hubs at Magna Park. With local consultancy, you get faster on-the-ground support and tailored cover for the industries that dominate the MK economy.

Cyber insurance doesn’t replace your firewall, antivirus, or staff training—it works alongside them. Even with strong defences, breaches can still happen. Insurance ensures that if ransomware, phishing, or insider risks compromise your systems, the financial, legal, and reputational costs don’t fall solely on your business.

Yes, while insurance can’t remove your GDPR responsibilities, it can cover the costs of legal defence, ICO investigations, and in some cases financial penalties where legally insurable. More importantly, it funds expert advice and communication to help you respond lawfully and minimise further risk.

Any business relying on digital systems is vulnerable. Financial services firms, professional services, logistics companies, healthcare providers, manufacturers, and retailers in Milton Keynes face daily risks, from phishing and data theft to ransomware and supply chain disruption. Even small firms with limited cyber security are attractive targets for criminals.

When an incident occurs, your insurer activates an emergency response team. This includes IT forensics specialists, legal experts, and PR advisors. They contain the threat, restore systems, handle GDPR notifications, and manage customer communications. Compensation for lost income and third-party claims is then processed as part of your policy.

Yes. Remote and hybrid work increases exposure to risks like phishing, unsecured devices, and VPN breaches. Cyber insurance policies are designed to protect businesses with distributed teams, covering incidents whether they happen in your Central Milton Keynes office or through an employee working from home.

We’ve protected Milton Keynes businesses from costly and devastating cyber threats, combining expert insurance solutions with responsive local service. Whether you’re based in Central Milton Keynes’ financial district or Magna Park’s logistics hub, we’re your local partners when digital security matters most.

From startup to established enterprise, don’t leave your digital future to chance. Cyber insurance with Bluebell is fast, flexible, and designed specifically for businesses like yours.

Cyber threats don’t wait for Milton Keynes businesses. Neither should you.

© 2026 Bluebell IT Solutions - All rights reserved

SEO and Website Design by Loop Digital