Home » Cyber Insurance Northampton

Get covered against data breaches, cyber-attacks, and business interruption with expert support from Northampton’s trusted IT and security specialists.

Cyber insurance is your business’s safety net against the digital threats that keep you awake at night. There could be ransomware attacks that lock your files. Phishing attacks targeting your team. Data breaches expose customer details. When these cyber threats strike, traditional business insurance can’t help you, but cyber insurance does.

Cyber insurance covers the costs, including legal fees, IT recovery, data restoration, crisis management, and regulatory fines. This isn’t a replacement for good cybersecurity, but instead, consider this a backup plan when technology fails.

Have an enquiry? We’re just an email or call away!

Cybercrime is surging across Northamptonshire. Local SMEs handling customer data, payments, or cloud operations are prime targets. If you’re a solicitor’s office on St Giles Street or a manufacturer in Brackmills, cyber criminals don’t discriminate.

A single ransomware attack in the East Midlands costs businesses an average of £16,000 in recovery and downtime. That’s before you factor in lost customers, regulatory fines, and reputational damage.

The question isn’t if you’ll face a cyber threat, it’s when. And when that moment comes, cyber insurance could be the difference between recovery and closure.

Our flexible cyber policies are built to suit your sector, size, and risk profile. Every cyber policy we arrange covers two critical areas: protecting your business directly (first-party coverage) and protecting you from claims by others (third-party coverage).

Last year, cybercrime cost UK businesses £21 billion. Your Northampton company could be next.

Any business could become a victim of a cyber attack, ranging from small retail shops to manufacturing firms.

Many businesses still believe that they’re too small a business to be targeted for a cyberattack. But the truth is, no business is immune to cyber threats. If you handle customer payments, store data in the cloud, or simply use email, your business could already be a target.

The cost of waiting isn’t just financial. It’s also your reputation, your customer relationships, and potentially your entire business. Local competitors who get hit by cyberattacks often never fully recover.

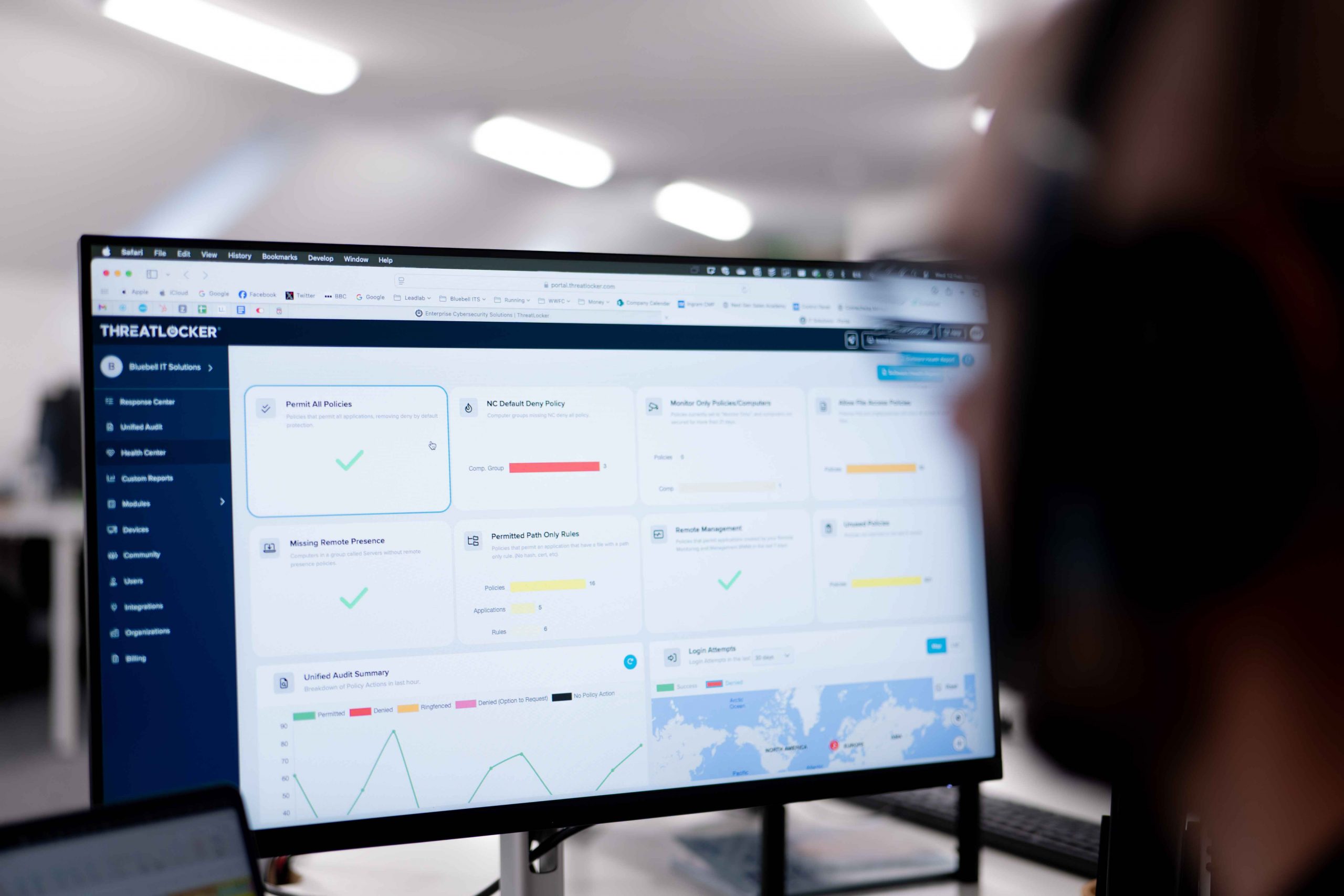

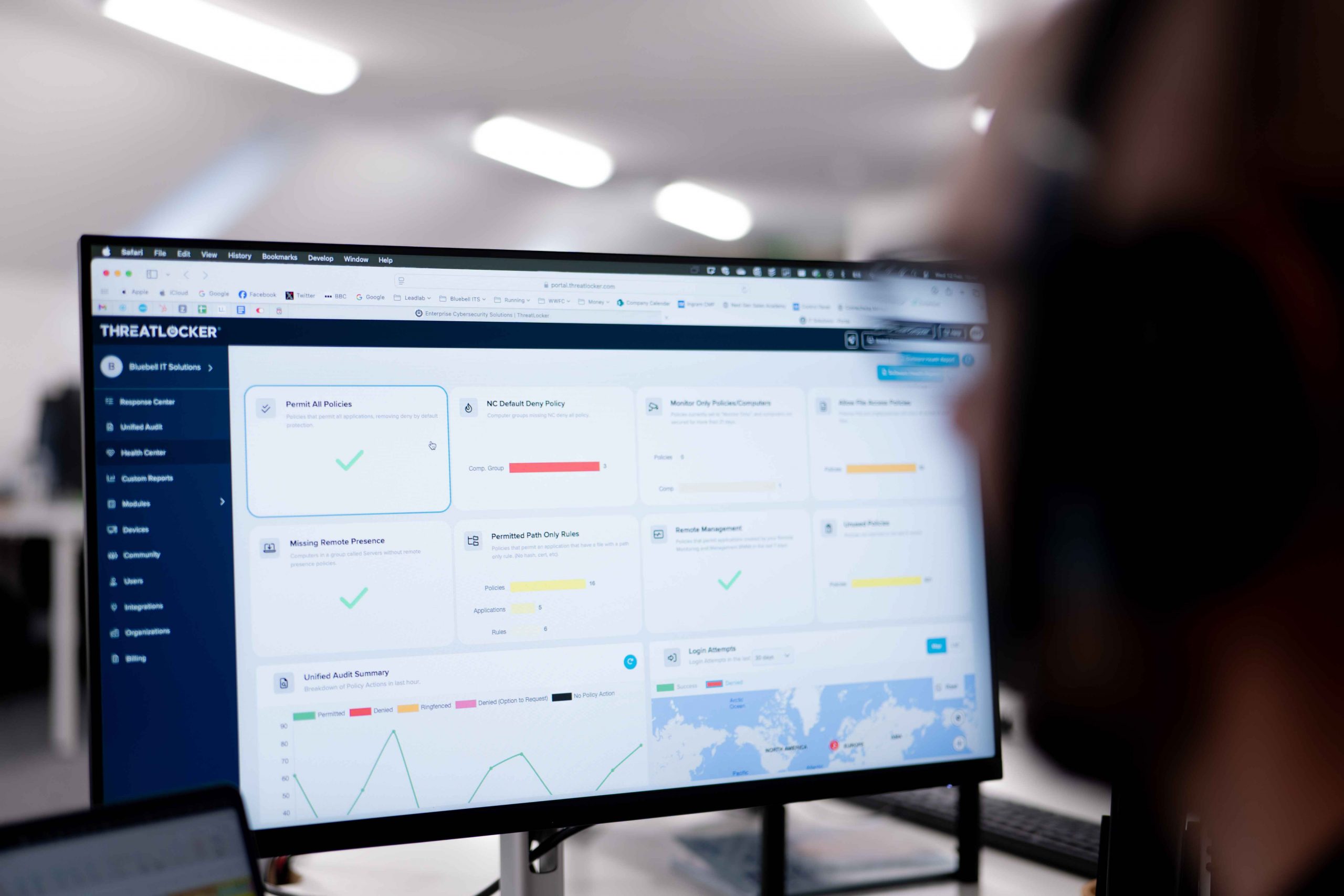

But here’s what’s different about working with Bluebell: We’re not some faceless national broker. We’re based right here in Northampton. We understand the local business landscape. When something goes wrong, we’re here, not at the end of a distant call centre.

You need cyber insurance if you:

Even micro-businesses are at risk. A single phishing email targeting your office manager could result in major financial, reputational, and legal harm.

Think you’re too small to be targeted? Cyber criminals often prefer smaller businesses. You have valuable data, but typically weaker defences than large corporations. You’re the perfect target.

Professional services firms handling client confidentiality need cyber cover for small businesses to protect against data breaches that could destroy client trust.

Retail businesses processing payments need protection against card data theft and e-commerce attacks.

Healthcare providers must safeguard patient records and comply with strict data protection rules.

Manufacturing companies risk intellectual property theft and supply chain disruption.

The reality is simple: if your business struggles to operate without computers, phones, or the internet, you need cyber insurance.

If you think cyber insurance is just another business expense, then it is time to think again.

Without insurance, you’re becoming responsible for the expenses incurred for IT forensics, legal fees, customer communication, downtime, and potentially compensation claims.

Cyber threats aren’t slowing down. Stop thinking of investing in cyber insurance as an option. Instead, make it a part of your business’s modern risk management.

Want to know what cyber cover for your Northampton business will actually cost?

Our free risk assessment takes just 15 minutes and gives you clear, tailored pricing based on your size, industry, and current cyber protections.

Understanding the threats helps you understand why cybercrime insurance matters.

Real Threats Targeting Northampton Businesses:

Here’s what you can expect when you’re protected:

You’ll be connected with cybersecurity specialists promptly. They’ll contain the breach, investigate the source, and prevent further damage.

Experts analyse how the attack occurred, what was accessed, and whether data was stolen.

You’ll get legal guidance to meet GDPR or ICO reporting requirements. If fines apply, they may be covered (where legally permitted).

Your policy includes costs for informing affected individuals and managing the public narrative.

We help you get back online safely, reducing downtime and restoring trust.

If customers take legal action or the ICO investigates, you’re covered for defence costs and compensation payouts.

We’re Northampton cybersecurity experts who understand your local challenges.

Cyber liability insurance covers a wide range of risks and costs linked to cyber incidents. This includes financial losses from business interruptions, legal expenses from customer claims, and the cost of investigating and recovering from data breaches, phishing attacks, or malware infections. It typically includes both first-party (your business’s own losses) and third-party (claims made against you) coverage.

Yes. Most cyber insurance policies cover the costs associated with ransomware incidents, including ransom payments (if legally allowed), data restoration, system repairs, and lost business income. Many also provide crisis support services such as negotiation specialists, legal advisors, and communication experts to help manage the fallout effectively.

Cover can usually be arranged within 2–5 working days following a cyber risk assessment. If you need cover urgently, Bluebell offers fast-tracked policies and may provide interim cover during underwriting to ensure you’re protected from day one.

While cyber insurance isn’t a substitute for GDPR compliance, it plays a crucial role in mitigating the financial and legal risks if a breach occurs. If the ICO investigates your business following a data breach, your policy can cover legal representation, regulatory liaison, and, in some cases, fines, depending on your policy terms and local laws.

Your insurer will activate an incident response team to guide you through every step. This may include forensic IT specialists to investigate the breach, legal experts to advise on compliance, public relations professionals to protect your reputation, and services to notify affected individuals, helping your business recover quickly and lawfully.

“Excellent service for our company’s IT requirements. Quick to respond and resolve, and very knowledgeable of the sector”. – Managing Director

“Bluebell supports our IT and telephony systems and has been great — from on-site installs and upgrades to ongoing support”. – Sales Engineer

“Working with Bluebell, we’ve just obtained our Cyber Essentials Certification” Commercial Director

“Bluebell stepped in after our previous supplier failed to maintain service levels, and they have been outstanding from day one”. – Operations Support Manager

“Bluebell IT offer great value for money, helping keep our company competitive and cutting edge” – Director of Technology

We’ve supported Northamptonshire businesses from expensive and devastating cyber threats, combining expert cyber protection with responsive local service. If you’re on Abington Street or Brackmills, we’re just around the corner when it matters most.

Whether you’re a startup or SME, don’t leave your digital future to chance. Cyber insurance with Bluebell is fast, flexible, and built for businesses like yours.

© 2026 Bluebell IT Solutions - All rights reserved

SEO and Website Design by Loop Digital