Home » Cyber Insurance Bedford

Shield your business from ransomware, data breaches, and cyber disruption with comprehensive protection from Bedford’s trusted cybersecurity and insurance specialists.

Cyber insurance provides your business with essential protection against the digital threats that could cripple your operations overnight. From ransomware attacks that encrypt your customer database to phishing schemes targeting your accounts payable team, cyber criminals don’t discriminate by business size or location.

When sophisticated attacks bypass your security measures, traditional business insurance offers no relief. Cyber insurance fills this critical gap, covering forensic investigations, legal expenses, data recovery, crisis communications, business interruption, and regulatory fines.

This isn’t about replacing good cybersecurity practices, it’s about having professional backup when technology and human defences fail.

Have an enquiry? We’re just an email or call away!

Bedford’s thriving business community along the A421 corridor faces escalating cyber threats. From manufacturing firms at Priory Business Park to hospitality operations like Brewpoint, local businesses handle valuable customer data and payment information that criminals actively target.

National statistics reveal concerning trends affecting Bedfordshire businesses. UK companies face new cyber attacks with alarming frequency, and many Bedford enterprises remain unprepared for the financial and operational consequences.

A typical ransomware attack in the East Midlands now costs businesses an average of £19,200 in immediate recovery and downtime costs. This figure doesn’t account for lost customers, regulatory penalties, legal claims, or long-term reputational damage affecting Bedford businesses’ market position.

The reality for Bedford business owners is clear: cyber incidents aren’t a matter of ‘if’ but ‘when’. When that moment arrives, comprehensive cyber insurance could determine whether your business recovers or closes permanently.

Our cyber insurance policies are carefully structured for Bedford’s diverse business landscape, from A421 corridor logistics firms to innovative engineering companies at Cardington. Each policy delivers robust protection across two critical areas: direct business protection (first-party coverage) and third-party liability coverage.

Last year, cybercrime cost UK businesses £21 billion in direct losses. Bedford companies are increasingly in criminals’ crosshairs.

Whether you’re operating from Interchange Park Kempston’s retail facilities, managing supply chains from Priory Business Park, or developing innovative solutions at Cardington’s aerospace hub, your business generates and processes data that criminals want to exploit.

Many Bedford business owners still assume they’re too small or local to attract cyber criminals’ attention. This assumption proves dangerous. If your business accepts customer payments, stores data in cloud systems, or relies on email communications, you’re already a potential target.

The true cost of postponing cyber protection extends far beyond immediate financial losses. It encompasses your carefully built reputation, established customer relationships, and potentially your entire business legacy. Local competitors who experience significant cyber incidents often struggle to rebuild their market presence.

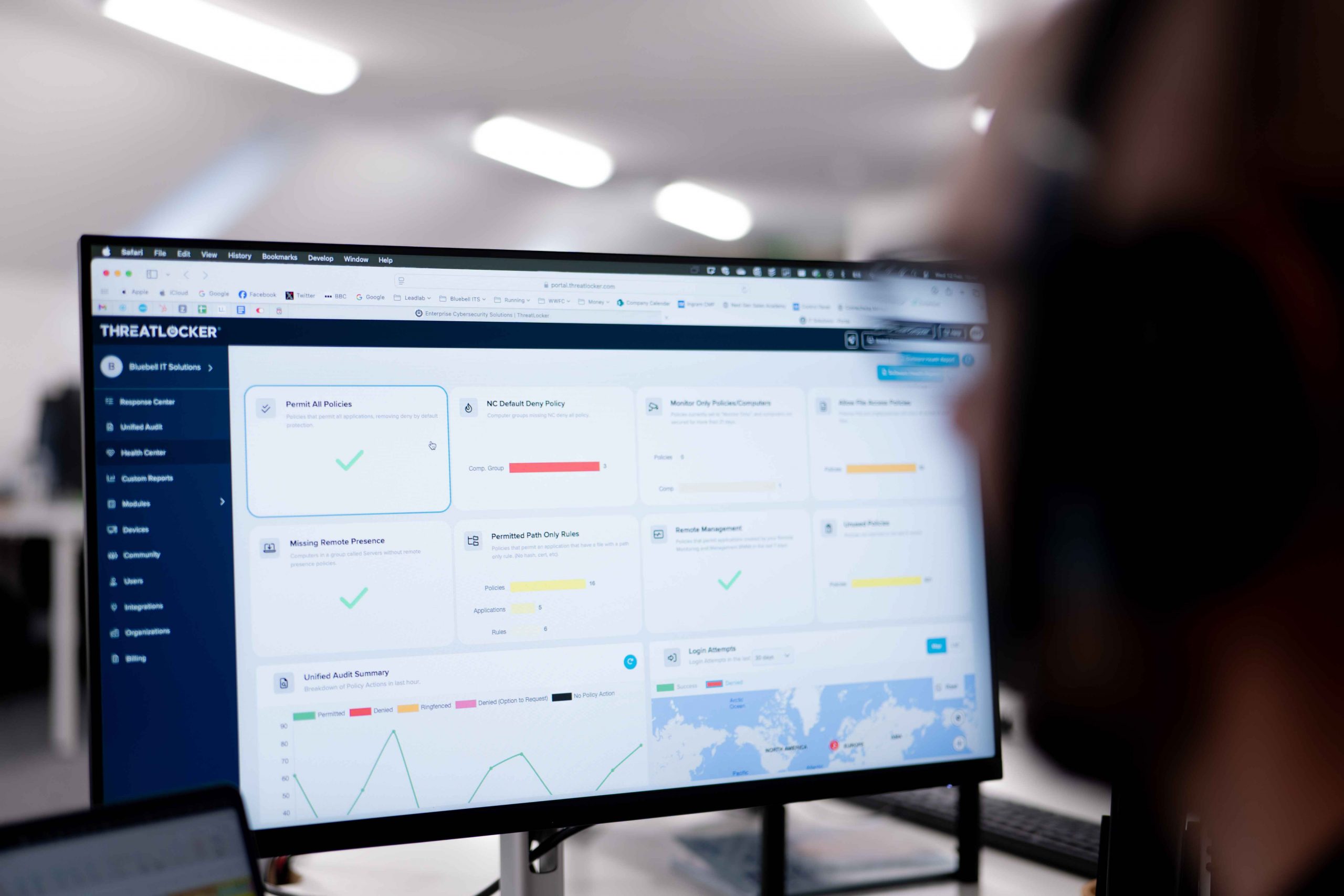

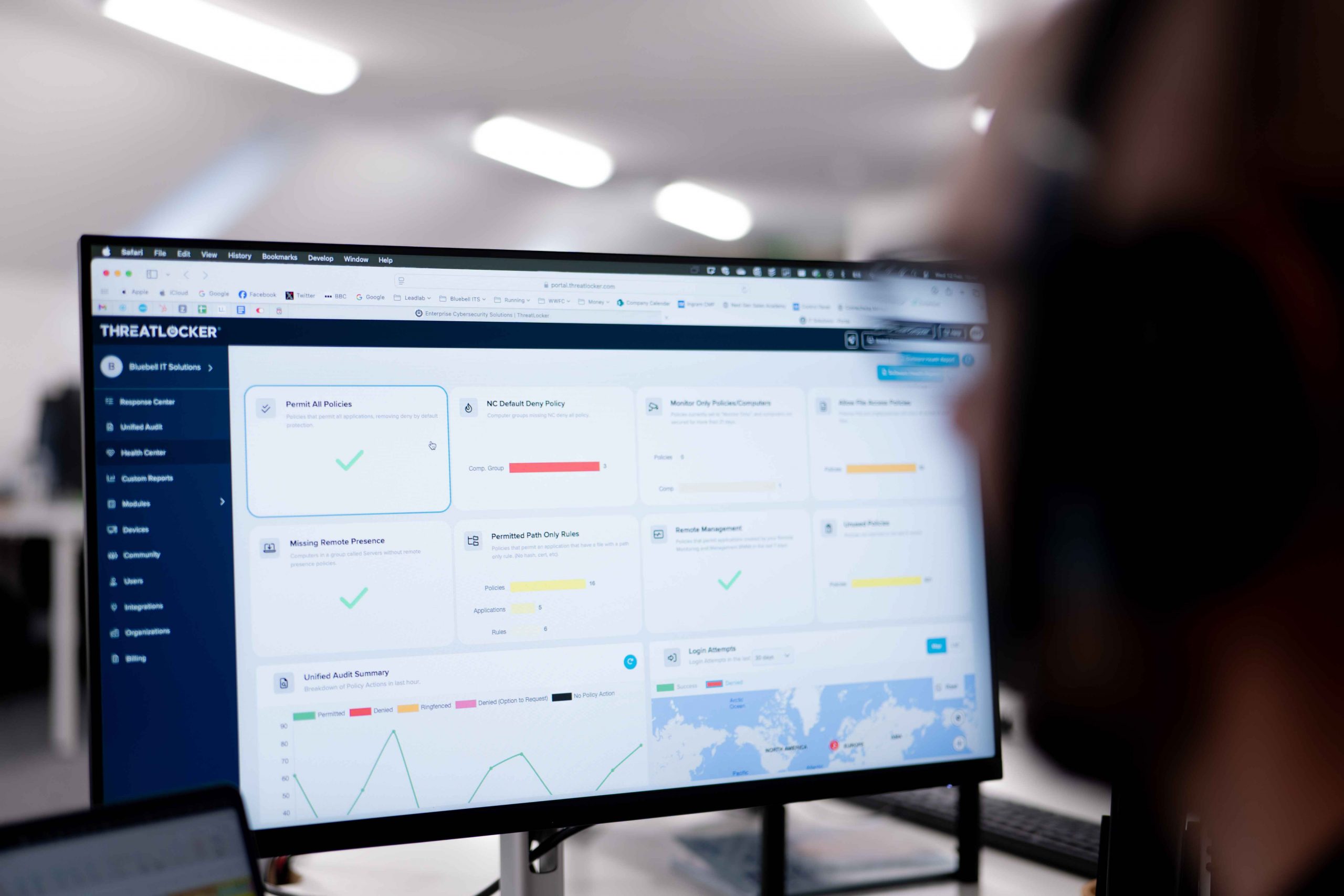

Bluebell’s advantage lies in our intimate knowledge of Bedford’s business landscape. We’re not an impersonal national broker—we understand the local commercial environment. When cyber incidents occur, we provide immediate local support, not distant call centre assistance.

Your Bedford business requires cyber insurance if you:

Even micro-enterprises face substantial cyber risks. A single successful phishing attack targeting your Kempston office manager could trigger significant financial, legal, and reputational consequences.

Believe your Interchange Park business is too small for cyber criminals? Think again. Smaller businesses often attract more attention because they possess valuable data and payment systems while typically maintaining weaker security defences than large corporations. You represent an attractive target.

Professional services firms across Bedford need protection against client data breaches that could devastate professional relationships and regulatory standing.

Retail and hospitality businesses processing customer payments require security against payment data theft and online system compromises.

Healthcare providers must safeguard patient information while maintaining strict regulatory compliance standards.

Manufacturing and logistics companies face risks from intellectual property theft, supply chain disruption, and operational system attacks.

If your Bedford business depends on computers, internet access, or digital systems to operate effectively, cyber insurance represents essential protection, not an optional expense.

If you’re viewing cyber insurance as simply another business cost, consider these financial realities.

Without insurance coverage, your business bears full responsibility for digital forensics, legal representation, customer notifications, operational downtime, and potentially substantial compensation claims.

Cyber threats continue to intensify across Bedford’s business community. View cyber insurance not as discretionary spending, but as fundamental protection for your company’s survival and growth.

Want to understand cyber protection costs for your Bedford business?

Our free risk assessment requires just 15 minutes and delivers transparent, tailored pricing based on your business size, industry sector, and current cybersecurity measures.

Understanding the threat landscape explains why cyber insurance matters for Bedford companies.

Active Threats Against Bedford Operations:

Here’s how cyber insurance supports your Bedford business during incidents:

You’ll connect with cybersecurity specialists who’ll quickly contain the breach, investigate the attack method, and prevent additional system compromise.

Experts determine exactly how the attack occurred, which data was accessed, and whether information was stolen or corrupted.

You’ll receive professional legal guidance to meet GDPR and ICO reporting requirements. Where legally covered, regulatory penalties may be included.

Your policy includes costs for notifying affected parties and managing public communications to protect your business reputation.

We help restore your Bedford operations securely and efficiently, reducing downtime and rebuilding stakeholder confidence.

If customers file legal claims or regulators investigate, you’re covered for defence costs and compensation payments.

We’re Bedford cybersecurity specialists who understand your local business environment.

Yes. Many policies include protection for Business Email Compromise (BEC) and invoice redirection scams, which are among the most common attacks in Bedford. If a fraudster tricks your finance team into transferring money to a criminal account, cyber insurance can help recover losses and cover legal and investigation costs.

Reputation is one of a business’s most valuable assets. Comprehensive policies fund crisis communications, PR support, and stakeholder notifications. This helps Bedford businesses reassure customers, suppliers, and regulators quickly, reducing long-term brand damage after an attack.

Traditional business insurance covers physical risks such as fire, theft, or property damage. Cyber insurance is designed for digital risks—ransomware, phishing, data breaches, and system outages. Standard policies usually exclude these, which is why Bedford businesses need a dedicated cyber policy for complete protection.

Yes. Remote and hybrid working increases exposure to phishing, unsecured devices, and VPN breaches. Cyber insurance covers incidents linked to employees working from home, travelling, or connecting via personal devices, ensuring your business remains protected no matter where your team logs in.

Yes. Supply chain attacks are on the rise. If a trusted supplier or IT partner is compromised and it disrupts your operations, your policy can cover downtime, lost income, and associated costs. This makes it particularly valuable for Bedford firms reliant on logistics and just-in-time supply chains.

“Excellent service for our company’s IT requirements. Quick to respond and resolve, and very knowledgeable of the sector”. – Managing Director

“Bluebell supports our IT and telephony systems and has been great — from on-site installs and upgrades to ongoing support”. – Sales Engineer

“Working with Bluebell, we’ve just obtained our Cyber Essentials Certification” Commercial Director

“Bluebell stepped in after our previous supplier failed to maintain service levels, and they have been outstanding from day one”. – Operations Support Manager

“Bluebell IT offer great value for money, helping keep our company competitive and cutting edge” – Director of Technology

We’ve safeguarded Bedford businesses from expensive and devastating cyber threats, combining professional insurance solutions with responsive local service. If you’re based at Priory Business Park or Interchange Park Kempston, we’re your local partners when cybersecurity matters most.

From startup to established enterprise, don’t gamble with your digital future. Cyber insurance with Bluebell is fast, flexible, and designed specifically for businesses like yours.

© 2026 Bluebell IT Solutions - All rights reserved

SEO and Website Design by Loop Digital